How to send money to Cuba from the United States

Sending money to Cuba from the United States can be a complicated task. Despite being two neighboring countries and the fact that millions of Cubans or Cuban descendants live in the United States, historical differences between the two countries complicate the transfer of funds to the island.

However, due to the partial dollarization of the Cuban domestic market and also thanks to technological advances, there are now alternative methods to send money to Cuba.

In this article you will find the necessary information that will help you choose the most convenient method to send remittances to your family or friends in Cuba. We want you to be able to send money in the fastest, safest and easiest way possible. Please read on.

Who can I send money to in Cuba from the U.S.?

Maybe in the future, if U.S.-Cuba relations return to a period of détente, the situation will change. But right now, as we write these notes, sending money to Cuba is limited to close relatives.

According to the U.S. government’s Code of Federal Regulations, relatives or close family members include anyone who is related by blood, marriage or adoption and who is three generations or less apart.

This means that U.S. residents can send remittances to Cuba as long as they are funds intended for:

- Parents

- Grandparents

- Great-grandparents

- Uncles

- Great uncles and aunts

- Siblings

- Nephews and nieces

- Cousins

- Second cousins

- Spouses

- Children

- Stepchildren

- Grandchildren

- Great-grandchildren

It is important to note that the U.S. Treasury Department prohibits sending money to any member of the Cuban Communist Party, regardless of the degree of relationship.

The rule means that if your close relative in Cuba holds a government position or has relatives in the government you should not send remittances to them. However, we know that this is a rule that is constantly violated by Cubans living in the United States. It is very difficult for the U.S. Government and authorities to verify who the final recipients of remittances are.

Documentation required to send remittances from the U.S. to Cuba

There are several methods of sending money to Cuba, each may have its own list of requirements.

Generally, the following documents are at the center of the documentation required to send remittances to Cuba:

- Photo identification document issued by the U.S. government.

- Full name of the beneficiary of the remittance.

- Physical address of the beneficiary.

- Degree of relationship.

It is very likely that in some cases you will need to include other information such as:

- Identity document of the person who will receive the money in Cuba.

- Magnetic card number of your relative in Cuba.

In the case of electronic or internet transfers, the sender of the remittance will also have to provide his or her debit credit card number to execute the payment.

Remittance options

Despite the obstacles and difficulties in the relations between Cuba and the United States, there are several options for sending remittances to the island. These are the methods currently available so you can send money to your family in Cuba,

Financial institutions (banks)

Bank-to-bank money transfers are prohibited between the United States and Cuba. This means that U.S. banks cannot make financial transactions to Cuban banks.

U.S. sanctions have also caused many banks in other countries to cancel or minimize their relationships with Cuban financial institutions.

However, many banks outside the United States do have commercial, contractual and correspondent relationships with Cuban banks.

If you have and operate a bank account in a country other than the United States, that banking institution may allow you to transfer money directly to a bank account in Cuba.

U.S. law allows Cuban citizens residing on the island to open bank accounts within the United States. This facilitates account-to-account transfers, as long as they are limited to authorized transactions.

Cubans residing in Cuba with U.S. bank accounts should confirm that the bank’s internal regulations allow them to use their debit cards inside the island.

Traditional money remittance companies to Cuba

During Donald Trump’s term, at the end of November 2020, the U.S. government issued a new rule regarding sending remittances to Cuba.

From that moment on, sending remittances became more difficult. One of the most traditional remittance companies, Western Union, was forced to close more than 400 offices in Cuba and cancel its operations on the island.

Democrat Joe Biden assured during his presidential campaign that he would resume Obama’s rapprochement with Cuba, a promise he has not kept.

At this moment, remittance companies do not know how and when they will be able to resume their operations linked to Cuba.

Apps and other remittance options

Current restrictions on sending money to Cuba also limit the operation of mobile apps that you typically use to send money to family or friends almost anywhere in the world.

Digital applications dedicated to financial services with offices in the United States, such as PayPal or Payoneer, are not authorized to offer their services in Cuba.

This situation and these limitations have led to the emergence of alternative methods to send money to Cuba.

The following are some of the options available for Cubans in the United States to send money to their relatives in Cuba:

Remittance Agencies to Cuba

Currently, a large number of Cubans in the United States send cash to their relatives in Cuba using services known as “remittance agencies”, “parcel services” or “mule agencies”.

Many of these companies operate through passengers who travel to Cuba and transport the cash for home delivery to their beneficiaries.

Some well-known agencies with home delivery are:

The vast majority of these agencies usually charge very high fees of up to 40% for each money transfer.

They are also not known for being very fast. It can take several weeks for the money to reach the recipient.

Faced with a scenario full of limitations, these remittance agencies tend to be used massively by Cubans in the United States. In a context without economic and financial sanctions, we could classify them as agencies that offer an inconvenient and deficient service.

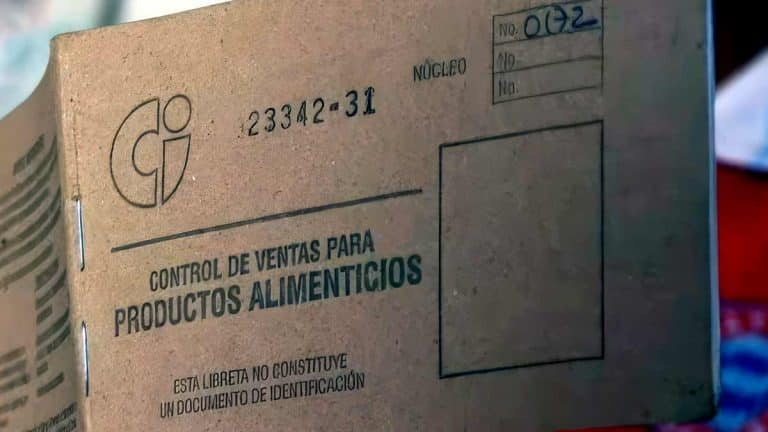

AIS and MLC recharge cards

Another option to send remittances to Cuba are the magnetic prepaid cards in freely convertible currency (MLC) and the American International Service (AIS) cards.

Although these cards cannot receive money directly from the U.S., U.S. residents are allowed to use Canadian transfer services to send money without government restrictions.

With this type of service, you will need to open an account with the company processing the transfer. As this is a Canadian service, your transaction will be processed in Canadian dollars, so you will need to take this into account when calculating your remittance costs.

It is preferable that your beneficiary has an AIS or MLC card before you process the transfer. However, some of these companies process cards in the name of your relative in Cuba as part of their services.

Your family members in Cuba can apply for your AIS or MLC card without an initial deposit.

These cards also do not require a minimum balance. They function as a method of payment at certain merchants and allow your family members in Cuba to purchase products in dollars.

At present, Cuba is going through a strong economic crisis and the MLC stores (in dollars) are the only ones that are moderately supplied.

Some of the companies that offer the service of recharging magnetic cards in dollars in Cuba are:

Sending cryptocurrencies to Cuba

The cryptocurrency fever has also reached Cuba. In fact, many cryptoasset enthusiasts claim that cryptocurrencies are the ideal way to send remittances to Cuba, because they are assets that cannot be blocked or regulated by U.S. financial institutions.

For those who do not know, digital currencies are decentralized, and have no flag or country, they are not subject to the regulatory authority of any central bank or similar financial institution.

Sending cryptocurrencies is perhaps, right now, one of the easiest and cheapest ways to make transfers to Cuba. The big problem with cryptocurrencies is still the majority ignorance of how these cryptocurrencies work, especially inside Cuba.

How to send cryptocurrencies to Cuba? The process is relatively simple. The first thing you need to do is buy cryptocurrencies using an exchange platform.

Then you can transfer those cryptocurrencies quickly and securely to the digital wallet of your relative or friend in Cuba.

Cryptocurrency transfers are safe and much faster than using the services of a remittance agency.

However, it should be noted that the value of cryptocurrencies fluctuates greatly. Cryptocurrencies are extremely volatile, they can gain or lose much of their value from one moment to the next.

The Cuban government has considered incorporating cryptocurrencies, but Cuban legislation in this regard is still far from being absolutely clear.

Cryptocurrencies are not legal tender within the island. The family member who receives the cryptocurrencies in his or her electronic wallet must sell them if he or she wishes to exchange them into Cuban pesos or other currencies circulating in Cuba’s informal exchange market.

Gradually, platforms dedicated to the use of cryptoassets have emerged within Cuba. There is, for example, Qvapay, a service that offers a rechargeable debit card using cryptocurrencies. This type of service facilitates the exchange of cryptocurrencies to Cuban pesos.

Encomiendas

Despite advances in the use of e-wallets and cryptocurrency transfers within Cuba, the most popular methods of getting money to people on the island remain informal pias. This situation is caused by the difficulty in getting money to the island through formal and legal channels in force in much of the world.

There are people whose business is to physically travel to the island and personally carry the money you wish to send to your relatives. These people usually charge a commission for each delivery of money.

There are also people with large amounts of cash inside Cuba, who receive money inside the United States and promise to deliver money to the sender’s relatives on the island. They also operate by charging notably high commissions.

This type of informal method of sending money often carries the risk of fraud. There is no legal contract with the service provider, but Cubans tend to use this form of remittance with assiduity.

The boom in this form of sending money to Cuba makes it very difficult to make accurate estimates of the total amount of remittances being sent to Cuba.

As a recommendation, it is preferable to avoid informal parcels. If you have no other option to send money to Cuba, make sure you at least send the money with someone you know personally. Also, notify your relatives inside the island that you are sending money to them. Also let them know all the details of how and when to pick up the sent cash.

Costs and taxes for sending remittances from the U.S. to Cuba

The costs of sending money to Cuba vary, depending on the method you choose to use.

Until relatively recently, the Cuban government charged a 10% tax on dollar remittances. This added to the cost of sending and made remittances increasingly expensive for Cubans abroad.

Due to the Covid-19 pandemic, Cuba recently eliminated this tax in an attempt to reactivate the economy.

Cost per transaction

Many of the services that deliver cash at home charge a fixed fee for these types of deliveries.

These fees can be as high as $20 for every $100 you send.

Before signing up for any service, confirm the shipping costs and make sure there are no additional hidden fees.

Percentage applied to the exchange rate

If you prefer to top up your family members’ AIS or MLC cards, the cost is usually 30-40% of the remittance because you must first convert your U.S. dollars to Canadian dollars and then pay the transfer fees.

The same goes for transaction fees, it is always best to confirm all costs before making any money transfers.

The fastest way to send money from the US to Cuba

Cryptocurrency transfers are the fastest way to process transfers to Cuba.

As they are immediate transactions, your family members can receive cryptocurrencies in a matter of seconds.

However, it is important to remember that sending cryptocurrencies requires a second step, as your relatives in Cuba will need to sell these digital currencies to obtain Cuban pesos.

How long does a transfer from the US to Cuba take?

Remittance transfers from the U.S. to Cuba take longer than remittances to other countries, due to existing government restrictions.

Remittance agencies can take up to two weeks to deliver the money, but they deliver it in cash directly to the beneficiary’s home.

Top-ups to AIS or MLC cards take approximately two days. Some recharge companies offer express service, which can be available in a matter of 1-3 hours. The disadvantage of these reloads is that they do not offer the option of cash withdrawals and can only be used in authorized stores.

How much money can be sent as remittances to Cuba?

Amendments to the Cuban Assets Control Regulations (CACR) made on September 9, 2019 imposed new limits on remittances sent to Cuba.

As of these changes, U.S. residents can send a maximum of $1,000 every 90 days (three months), only to their immediate family members in Cuba.

That means that the maximum amount a person in the U.S. can send to Cuba is $4000 per year.

It is quite common for Cubans in the U.S. to violate these regulations. However, violation of these regulations can result in criminal and civil penalties, depending on current law.

Prohibited transactions may be grounds for seizure by the Office of Foreign Assets Control, and you may lose your property or money.

The Code of Federal Regulations states that financial institutions are required to report any suspected violations to the U.S. Treasury Department.